GLOBAL MOBILITY SERVICES

Global Mobility Services (GMS) offered by National Energy Services Ltd. (NESL) provide end-to-end PEO, EOR and GER solutions for organizations operating in Bangladesh. Our services support international workforce deployment, expatriate management, and cross-border workforce support, helping companies remain fully compliant with immigration, tax, and labor regulations while efficiently managing their globally mobile workforce.

Our GMS practice combines tax advisory, compliance, and human resource services with technology-driven delivery, offering scalable solutions for both local and overseas employees. These services include:

- Placement of local and expatriate personnel on short and mid-term hire

- Payroll management and administration

- Employment structuring for tax efficiency and cross-border operations

- Payroll diagnostics, tax dispute resolution, and voluntary disclosures

- Global equity-based remuneration advisory

- Due diligence on employer obligations and tax liabilities

- Applications for tax incentives and rulings

- Tax equalization policy development and implementation

- Assignment tax cost projection

- Immigration advisory including e-Visa and work permit applications/renewals

- Extended business tax treaty reviews and compliance insights

- HR advisory services: compensation/benefits, contracts, HR policies, and practices

- Remuneration advisory and global talent mobility solutions

EMPLOYMENT SERVICES

LOCAL STAFFING THROUGH NESL EMPLOYMENT

Businesses can efficiently hire local employees in Bangladesh through NESL’s employment services.

All employees are directly employed by NESL and deployed to clients under agreed terms, ensuring compliance, professional administration, and smooth workforce integration.

NESL provides the following services in relation to Bangladeshi national staffing:

- Candidate shortlisting & final selection as per clients’ requirements

- Processing client-recommended candidates for smooth onboarding

- Employment of staff & contractors engaged under NESL’s employment framework

- Background, fitness & medical checks for employees

- Employee benefits administration coverage

- Timesheet collection & verification to ensure accurate payroll processing

- Payroll calculation including salary, overtime, and other payments for client’s approval

- Payroll processing and direct payment of salaries to employee bank accounts

- Monthly pay slip distribution in a timely manner to all employees

- Tax compliance, including AIT deductions and deposits on schedule

- Tax receipt management includes sharing copies of tax receipts with employees/clients

- Issuance of termination notices or letters as per client instructions

- Experience certificates & references provided for contracted employees, if required

EXPATRIATE PLACEMENT THROUGH NESL EMPLOYMENT

Bangladesh’s rapid growth in infrastructure projects and technological advancement has created strong demand for expatriate talent. Multinational organizations increasingly bring foreign professionals to Bangladesh for both short- and long-term assignments, covering roles from technical experts to senior managerial positions.

These assignments often involve knowledge transfer, implementation of global best practices, and specialized project execution, requiring careful planning to ensure regulatory compliance, tax efficiency, and smooth workforce integration. Without proper guidance, companies risk unnecessary tax burdens, double taxation, and compliance complications for their expatriate staff.

The purposes of these assignments vary from highly specialized to the company’s managerial representatives as well as from technical know-how to the implementation of new projects/policies or bringing in leading industry practices.

Adequate planning, knowledge, and preparations are essential in respect to placement and employment of foreign nationals for the purpose of lawful employment and movements, foreign exchange movements, and the tax and regulatory framework of the country by such corporates and their employees.

Unknown and unmanaged complexities of the tax system could result in higher tax costs, compliance, and double taxation issues in relation to expatriates that need resolution.

Further, as per the Bangladesh income tax law, a person may be liable to tax on his global income in Bangladesh after three to four years of his first arrival in Bangladesh. This necessitates the need for planning at the initial stage itself to plan on his tax residency as well as his duration of contract and rotational plans.

NESL provides end-to-end support for expatriate placement, helping companies navigate complex legal, tax, and immigration requirements while maximizing operational efficiency.

Key service offerings:

- Onboarding/Placement of deployment of expatriates in Bangladesh under NESL employment

- Work permit assistance to ensure lawful employment in Bangladesh

- Pre-employment guidance to optimize tax efficiency and benefits before expat arrival

- Contract review to assess employment agreements for regulatory and tax perspectives

- Tax planning & compliance to evaluate perquisites, benefits, and global tax obligations

- Tax equalization support to maintain fairness between employer and employee

- Plan assignments to manage tax residency status and duration

- Security registration assistance for different nationalities

- Assist with taxation-related certificates in order to assist assessment in the home country

- Assist with tax deductions, deposits, assessments and obtaining tax clearance certificates.

- Assist final tax clearances when cancelling work permits.

- Advise on exemption and tax credit mechanisms to employees of different jurisdictions.

- Determine taxability of employer’s and employee’s contributions to retirement benefits

Assist the expatriate for compliance requirements from their time of entry to their departure from Bangladesh, including tax registration, deregistration, filings, cancellation of work permits, closing bank accounts, tax clearances etc.

EMPLOYMENT RELATED IMMIGRATION RULES IN BANGLADESH

Immigration guidelines in Bangladesh

Employment by foreign nationals can take the form of the following visa categories:

E category:

- A) Experts / advisers / employees / individuals appointed in government / semi-government / autonomous bodies / projects and equivalent organizations

- b) Individuals employed in local/foreign government/semi-government/liaison/industrial/commercial organizations or other equivalent organizations

- c) Individuals appointed under local/foreign government/semi-government contractors and in equivalent organizations

E1 category: (individuals visiting for supply/installations/maintenance of equipment and software/supervision of project, etc.). These are issued for 90 days, renewable for another 90 days. No work permit is needed during this time. After that time, the employee will have to apply for the work permit.

A3 category: Experts / advisers / officials / staff members / laborers working on any project under the bilateral / multilateral agreement between the Bangladesh government and development partner agencies

FE category: Spouse and other dependent members of the principal traveling on E/E1 category visas

FA3 category: Spouse and other dependent members of the principal visiting with an A3 category visa

Any default in complying with the immigration guidelines could result in penal consequences, including deportation of the foreign citizen and adverse consequences for the organization.

It is important that appropriate categories of visas are issued for the foreign nationals and their dependents, including processing of visa extensions within the stipulated timeline.

Also, multiple issues in the tax and regulatory areas need to be addressed by the companies and their employees, including maintaining certain employment ratios. This may require a review of the entire assignment structure from time to time and the underlying international assignment policies.

WARNING FOR UNAUTHORIZED EMPLOYMENT

Apart from enforcement and reputation issues there are severe financial consequences from unlawful employment Bangladesh. Section 16B of Bangladesh Income Tax Ordinance 1984 states that where any person employs or allows, without prior approval of BIDA or any competent authority of Government, any foreign national work at his business or profession at any time during income year, such person (employer) shall be charged additional tax at the rate of 50% of his tax payable on his income or Taka 500,000 whichever is higher.

RECRUITMENT SERVICES

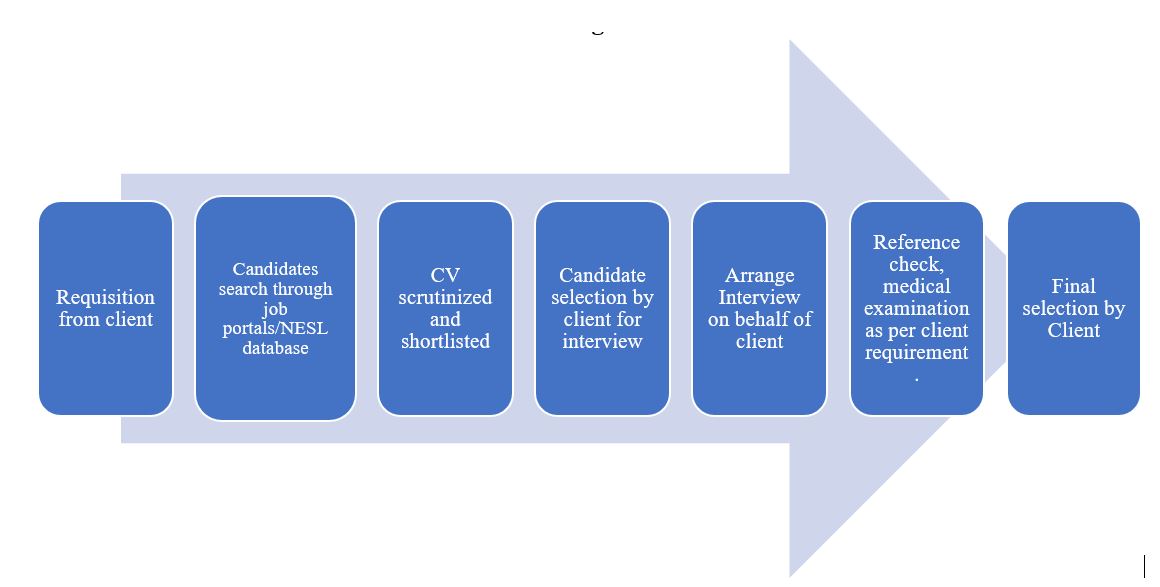

GENERAL RECRUITMENT FOR CLIENTS

NESL is engaged in placement services for its clients within the country and outside of the country. These positions may be for operational, supervisory, mid-management, senior management, senior executive, or even skilled worker level. By collecting details of job terms and conditions from clients, the NESL recruitment team searches for the right candidates, looking into strategies, research, and competitive analysis of its resources and the needs of its clients.

Remote candidates are interviewed through Cisco Webex.

Recruitments are done for:

-

- A) Permanent position

- B) Temporary on-demand, project-based positions

NESL recruitment service narrated in the following flowchart:

EXECUTIVE SEARCH

This method is usually applied for selection at the senior level, where we are requested to undertake a “complete search” assignment to locate suitable people without going for the advertisement procedure. When such headhunting is carried out, it is expected that our client would provide all information and requirements in order to facilitate identifying the right candidate.

TYPES OF PERSONNEL NESL CAN SUPPLY

Outsourcing is only comfortable and dependable when you have complete trust and confidence in the capability and quality of the human resources organization. NESL ensures an updated and proactive database as its inventory to cater to all you require right at this moment.

The NESL database caters to various geographical and technological needs of various local and multinational organizations. NESL services are comprehensive and can be shopped as one-stop services.

NESL has a rich database to provide the following categories of personnel:

| EHS Engineer | Tax Analyst |

| HR Manager | Manager – Custom & logistic |

| Medical Specialist | Drilling Engineer |

| Compliance Manager | Office Assistant |

| GP Operation Specialist | Field Representative |

| Accountant | Hydraulic Mechanic |

| Contract Administrator | Network Engineer |

| Maintenance Specialist (Mechanical) | Data Analyst |

| Training Coordinator | Procurement Engineer |

| Logistics Officer | Mechanic |

| Document Controller | Project Manager (High Voltage & Transmission) |

| Maintenance Engineer | Civil Engineer |

| IT Business and Financial Analyst | Surveyor (Building Construction) |

| Administrative Officer | Transport Coordinator |

| O&M Competency Trainer | Strategic Social Investment Manager |

| Technical Support Specialist-IT | Design Engineer |

| Business Analyst | Project Manager (PV/Solar) |

| Team Assistant | Marine Specialist |

| Warehouse & Logistics Coordinator | Earthworks & Drain Site Engineer |

| Procurement Officer | Civil Foreman |

| Facilities Coordinator | Cost Engineer |

| Computer Operator | Utility Coordinator |

| Electrician | Project Mentor |

| Project Engineer | Application Support Analyst |

| I&E Site Supervisor | Contract Administrator (D&C) |

| Construction Engineer | Government Affairs |

| Project Manager | Planning & Program Engineer |

| IT Engineer | Technical Support Specialist |

| MIQA Supervisor | Coring Engineer |

| Electrical Engineer | Lift, Escalator, Travellator Engineer |

| Accountant Manager | Sample Catcher |

| Wireline Field Service Supervisor | PSI Engineer |

| Equipment Maintenance Coordinator | Logistic Engineer |

| Manager – Marketing | Pile Work Supervisor |

| Equipment Operator | Production Engineer |

| Payroll Manager | Emergency Preparedness and Response Specialist |

| Structural Engineer | Interface Manager |

| Civil Site Engineer | Mud Logger |

| Construction Supervisor | CAD Operator |

| Mechanical Engineer | Project Control Coordinator |

| Material Coordinator | Chemical Engineer |

| Electrical Inspector | Interface Coordinator |

| Chemist | Scheduler |

| PBB/BHS Engineer | Software Developer |

| Well Site Manager | Welder |

| EPC Manager | Civil Site Supervisor |

| QA/QC Supervisor | Surface Well Tester |

| Construction Representative | Technician |

| Draftperson (civil) | Subsea Engineer |

| Quality Engineer | Stock Yard Supervisor |

| Architect | BIM Engineer |

| Laboratory Technician | Construction Manager |

| Security Engineer |

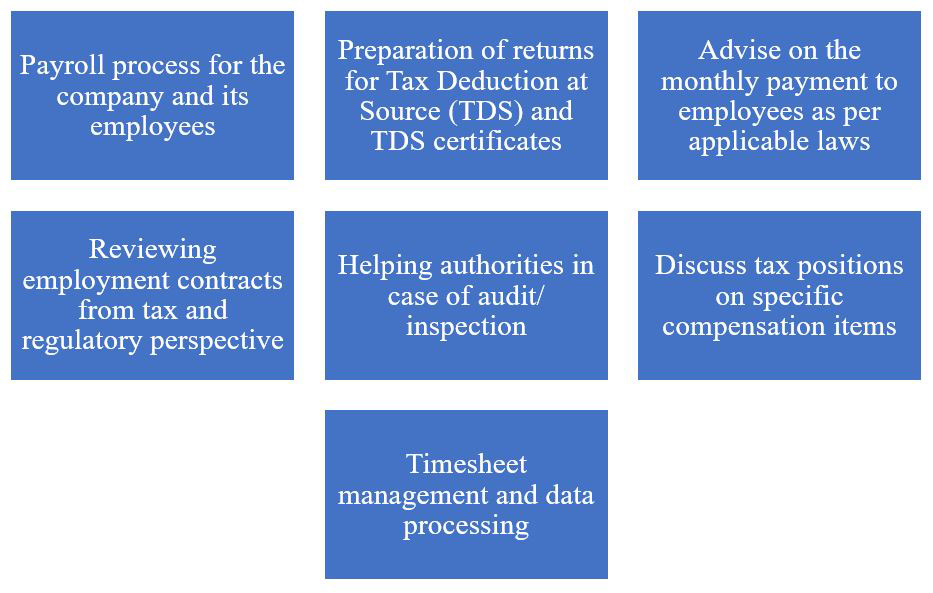

PAYROLL & TAXATION SERVICES

NESL PAYROLL SERVICE COVERAGE

As organizations continue to expand, managing payroll processes merits special consideration. To build, manage, and implement payroll-related operations and processes, one requires an organized approach. NESL focuses on payroll services to ensure:

- Tax-efficient management

- Efficient and timely administration

- Regulatory compliances

NESL offers the following services with regard to the payroll functions:

Most large enterprises transfer payroll services to third parties, as outsourced solutions are time- and cost-effective and more flexible and offer greater control for a company with large operating networks. NESL offers its services to its client by managing the payroll services in an efficient and accurate way.

The NESL payroll system maintains records of all employees irrespective of the nature of their payment (monthly or daily or hourly). Detailed records of take-home salary, tax deduction, workman’s liability insurance, medical history, personal accident insurance, gratuities, leave/severance/holiday/family allowance, medical/mobile/per diem/transport/annual allowances, bonus, termination pay, pensions, payment in lieu, sick/annual/casual leave calculation, and other benefits (accommodation, foreign allowance, etc.) are kept for future reference.

Sometimes, depending on the offer and nature of work, separate arrangements for work clothing, personal protective equipment, and medical examinations are provided.

The benefits and packages are up to the client and individual consultant/employee to agree on. NESL executes payroll administration as agreed by the parties.

PAYROLL DIAGNOSTIC

Due to its sensitivity, compliance, and volume, it is a service to be performed with near accuracy. As a result, effective payroll services require specialization and a clear understanding of the applicable laws.

With cross-border experience and exposure of NESL in dealing with a significant number of multinational companies operating in Bangladesh, NESL stands out to be one of the most experienced companies in dealing with local and expatriate payroll services.

Key service offerings:

NESL’s key service offerings include:

- Review existing employee compensation policies:

- Identify cost-ineffective components arising from admin or potential litigation costs

- Suggest tax-efficient compensation items wherever possible

- Review withholding tax computations, statements, and payments for adequacy of compliance

- Verify documents with regard to reimbursement claims from a tax compliance perspective

- Identify potential tax and penalty exposures due to non-compliance

- Highlight tax exposures that may lead to litigation with mitigating measures

- Evaluate cost-saving opportunities for viability and consistency within corporate philosophy

- Recommend implementable ‘leading practices’ on payroll policies and procedures

- Review applicability of Bangladesh labor laws.

EMPLOYEE COMPENSATION STRUCTURE

Expatriates of the high-skill category within certain industrial sectors receive significant compensation in the form of salaries, allowances, and benefits. However, international competitive biddings and changing global market conditions, along with resource sourcing from various regions, are putting pressure on organizations to be cost-conscious while remunerating employees in a tax-efficient manner.

BIDA prescribes a minimum salary structure for expatriates working in Bangladesh.

It is focused on ensuring that the structure that is offered meets:

- Minimum mandatory BIDA-prescribed salary

- Flexible and employee-friendly in terms of relocations, rotations, and work schedules

- Meets contractual requirements of clients

- Cost-effective

- Simple to administer

- Tax efficient

- Aligned with industry practices

Key service offerings:

-

- Use the NESL salary database to match with the package offered to the new client

- Use a globally published salary review

- Examine other compensation structuring options available to the organization

- Review BIDA salary recommendation

- Analysis of the current employee compensation structure so as to:

- Advise on the tax implications thereof

- Weed out policies that are not cost-effective due to administrative costs or potential litigation costs.

- Advise on the estimated tax liabilities based on potential compensation offerings

- Design a standard manual containing payroll policies and procedures

- Identify potential tax, interest, and penalty exposure (if any) for regulatory violations.

TAXATION SERVICES

NESL provides taxation services, which in turn save time and cost for clients and employees from managing complex accounting processes and mitigate their related compliance issues.

The services are as follows:

-

- Cross-border tax planning for the client

- Arranging issuance of Tax Identification Number

- Tax planning and management for local personnel

- Tax planning and management for foreign personnel

- Tax deduction / withholding tax at source and deposit to government treasury

- Issue a salary certificate mentioning tax deduction and deposit

- Tax return submission, tax assessment, and obtaining a tax certificate

ADMINISTRATIVE SERVICES

NESL IMMIGRATION SERVICES

NESL has vast experience in mobilizing expatriate consultants to the Bangladesh market. NESL is able to advise clients on the best way for them to proceed with their projects in Bangladesh. NESL’s potential clients can and have access to its one-stop service to resolve any employment, labor, contractual, taxation, immigration, compliance, and other related matters that affect the employment of international consultants/employees.

Wherever they are working in Bangladesh, NESL strives to ensure all of its consultants and employees arrive in the country legally and start their projects on time, with the right documentation like work permits and visas, with the assurance that they are lawfully employed.

It must be borne in mind that, like most countries, employment without an employment visa and work permit is prohibited in Bangladesh, whether paid or not or wherever they are paid.

NESL immigration services include the following:

- Arrangement of Employment Visa through NESL employment facility

- Arrangement of work permits and visas for foreign nationals through NESL employment

- Mobilization / demobilization of personnel

- Transportation, accommodation, and travel formalities for field staff

- Protocol and assistance services to expatriates of other companies

- Arrange immigration/visa services (like visa extension, category change, and multiple visas)

- Arrange customs clearance during arrival/departure of the staff

- Assist employees in obtaining local bank accounts in Bangladesh

- Airport reception and protocol

- Work permits and immigration services

- Security Clearance services

- Manage inward/outward remittance (FEX) on behalf of employees

- Settle the income tax routines for the employees as required by GoB

- Manage/settle all personal legal arbitration relating to the employees

- Arrange supplemental insurance not covered in the basic insurance of the employee

- Advisory services on foreign exchange remittances

Immigration requirements vary by nationality; employment from countries such as Indonesia, the Philippines, India, and Bangladesh may require special government approvals or clearances.

INSURANCE COVERAGE AND MANAGEMENT

NESL arranges medical insurance, medical evacuations, accidental death, and other related insurance coverage for its employees and its clients. The actual covered amount varies in line with the requirements of the client and the consultants.

The usual insurances that NESL manages for its foreign and national employees are as follows:

- Medical assistance and medical evacuation

- Accidental life insurance, including AD&D

- Hospitalization Insurance

- Group life insurance coverage

The charges and fees are prearranged with clients.

MEDICAL ADVISORY AND MANAGEMENT SERVICES

NESL manages a dedicated Emergency Medical Response Team to deal with medical emergencies. This division deals with medical advisory and referral services to both local and foreign hospitals. Pre-employment medical check-ups, routine and annual medical checks, and other job-related medical investigations are taken care of by this division. This division is independently operated by a group of medical professionals. The team operates within Bangladesh and caters to the need of our clients to look after their overall medical emergencies.

LOGISTICS AND ADMINISTRATIVE SUPPORT SERVICES

NESL offers the following logistics and administrative services, if requested by the client:

- Rents of offices & houses

- Rents of warehouses and yards

- Transportation, including protocol

- Local procurements

- Secretarial services

- Security services on contract

- Arrange transport for local usage at Dhaka as well as at the workplace

- Arrange a personal housekeeper for the staff at his accommodation

- Arrange ambulance services (as required) for the staff while at Dhaka

- Arrange doctors on call at the residence or at the doctor’s chamber as needed by the staff

- Coordination with various government bodies

- Procurement Assistance

- Training on database management and administration services

- Management services of foreign registered companies in Bangladesh

ADVISORY SERVICES

REFERRAL CHECK SERVICES

NESL offers referrals and background check services for Bangladeshi employees employed by our clients (both local and multinational companies).

This referral service includes:

- Police verification

- Academic certificate verification

- Employment document verification

- Residence address verification

- Reference verification

- Any other verification, if required by clients

- The charges and fees are prearranged with clients.

PROFESSIONAL SUPPORT SERVICES

NESL provides advisory services to its clients for various licensing assistance, which include:

- Managing foreign-registered (with Bangladesh Investment Development Authority, Bangladesh Bank, RJSC, etc.) companies in Bangladesh.

- Secretarial, including works related to Registrar Joint Stock Companies and Firms (RJSC)

- Trade license

- Import registration certificate (IRC)

- Export registration certificate (ERC)

- License to Electrical Firms and Contractors

- Indenting registration certificate (IRC)

- Fire license

- Environment license

- Factory / DIFE license

- Explosive license

- Financial services & risk mitigation.

- Documentation of work and inspection procedures

PROJECT MANAGEMENT & LOGISTICS SUPPORT SERVICES

PROJECT MANAGEMENT

NESL ensures holistic project execution, combining technical expertise, safety compliance, and operational efficiency. By delivering end-to-end project management and support services, NESL is trusted & recognized as a reliable and technologically advanced partner for multinational and local enterprises operating in Bangladesh.

This service includes:

- Geoscience, Drilling & Completion

- Engineering & Design

- Health, Safety, Environment & Quality (HSEQ)

- Construction, Commissioning, Operations & Maintenance

- Security Maintenance

- Cleaning & Maintenance

- Camp Project Services

LOGISTICS SUPPORT

NESL provides comprehensive logistics support solutions designed to streamline supply chain operations and enhance efficiency. By leveraging advanced planning tools and industry expertise, NESL helps clients optimize resources, reduce operational risks, and achieve seamless execution for projects of any scale.

This service includes:

- Meet-and-greet officer for 24-hour services

- Arrangements with hotels/clubs for short and/or long overlays

- Insurance, medical coverage, and evacuations

- Vehicle for transportation

- Accommodations and site management

- Catering services

- Translation services

- Domestic ticket arrangements, including options for international ticketing

- Mob/demo monitoring with client administration